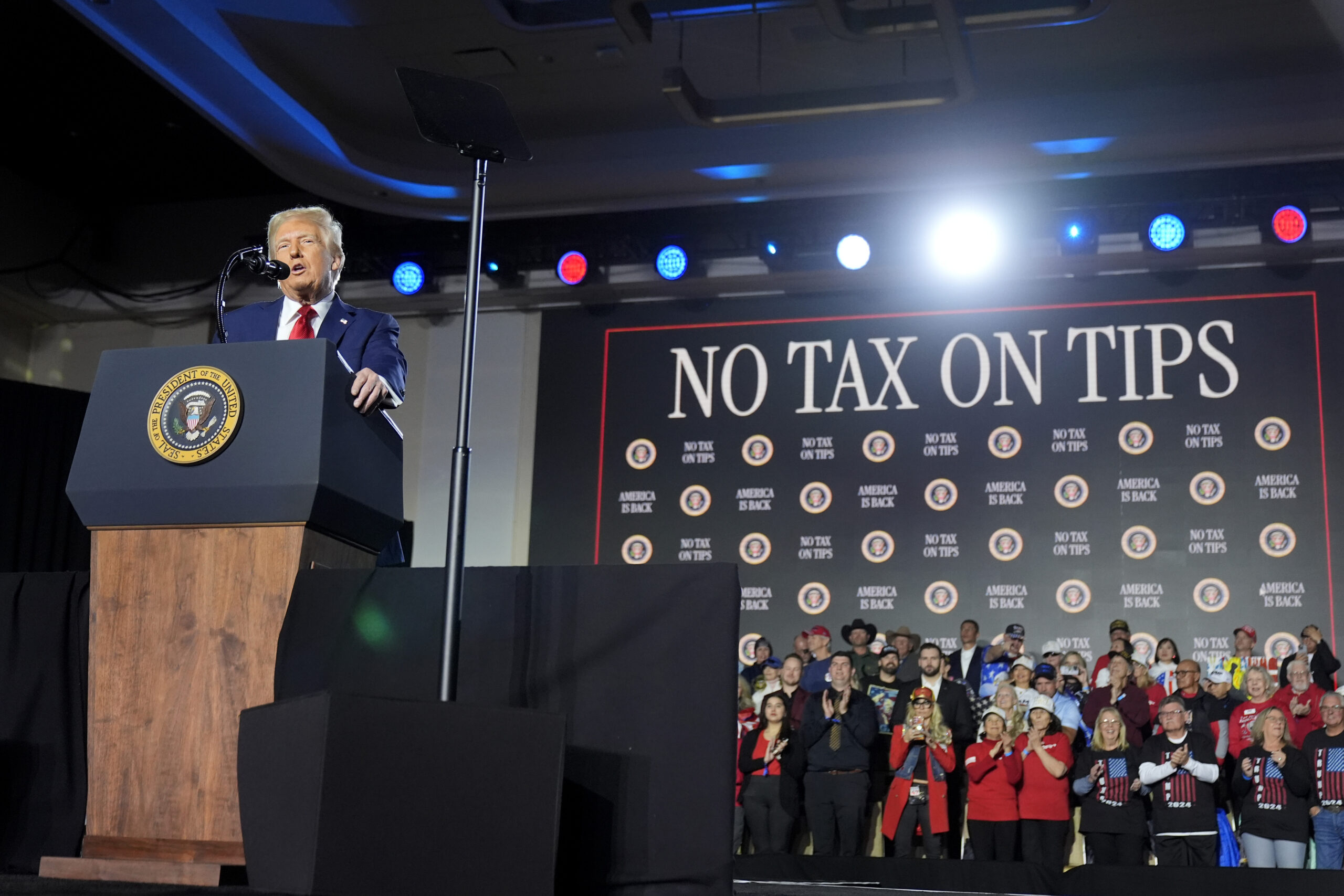

The political landscape in Nevada is heating up as candidates from both the Democratic and Republican parties square off over a proposed tax deduction for tips. This debate is expected to play a significant role in the run-up to the 2024 elections, with GOP candidates believing that supporting the deduction will resonate with working-class voters.

Republican candidates are actively promoting the idea that eliminating taxes on tips will provide financial relief to service workers and enhance their earnings. They argue that this policy aligns with the interests of everyday Nevadans who rely heavily on tipping as a major source of income. According to the Nevada Republican Party, this tax deduction could amount to significant savings for workers in the hospitality industry, a sector that employs thousands across the state.

On the other side of the aisle, Democratic candidates are working to counter this narrative. They claim that while the tax deduction may seem beneficial, it primarily serves to reduce government revenue, potentially jeopardizing funding for essential public services. They are urging voters to consider the broader implications of such a policy, emphasizing the need for a balanced approach to taxation that does not disproportionately favor certain sectors at the expense of the public good.

As the election date approaches, both parties are ramping up their campaigns. GOP candidates are framing their support for the tax deduction as a direct response to the financial pressures faced by working-class families. They argue that this measure could help stimulate the local economy by allowing service workers to retain more of their earnings.

In contrast, Democratic candidates are focusing on the potential long-term consequences of the proposal. They contend that the loss of revenue from the tax deduction could lead to cuts in vital services such as education and healthcare, which disproportionately affect low-income families. This argument is intended to resonate with voters who prioritize social services and public welfare over tax breaks for specific industries.

The debate over the tax deduction for tips is not merely academic; it reflects deeper issues regarding economic inequality and the role of government in regulating business practices. As the political battle unfolds, both parties will need to articulate their positions clearly and convincingly to sway undecided voters.

With the 2024 elections looming, the outcome of this debate could significantly influence Nevada’s political landscape. Voter sentiment is likely to play a crucial role in shaping the future of this tax policy and its implications for working-class Nevadans. The coming months will be pivotal as candidates continue to engage with their constituencies on this pressing issue.