Retailers across the United States are grappling with a significant shortage of pennies, forcing many to adapt their cash handling practices. This situation has emerged following the U.S. Mint’s decision to discontinue the production of one-cent coins, a move that has left businesses with no option but to undercharge customers or find alternative solutions.

Dylan Jeon, senior director of government relations with the National Retail Federation, highlighted the financial strain this shortage imposes. “You’re talking about losing up to four cents for every cash transaction across multiple stores across the country,” he stated in an interview with BBC News. He described the situation as “unsustainable,” emphasizing the need for immediate solutions.

The U.S. Mint halted production of pennies in August 2023, with the final order for penny blanks occurring in May of the same year. This decision stemmed from the rising costs associated with producing each penny, which had reached nearly four cents. In a social media post announcing the halt, former President Donald Trump remarked, “That’s government waste, plain and simple. The penny no longer makes cents.”

The ramifications of this decision are becoming evident at cash registers nationwide. Some outlets, including McDonald’s USA, have issued statements informing customers that exact change may not be available. McDonald’s is actively seeking long-term solutions to manage the impact of the penny shortage and continues to engage with the federal government for guidance.

Retail Responses to the Shortage

In light of the penny shortage, retailers are employing various strategies to mitigate losses without alienating customers. For example, Giant Eagle, a grocery chain based in Pennsylvania, recently announced a promotional event encouraging customers to turn in pennies for gift cards. During this event, customers will receive a two-cent gift card for every penny they submit.

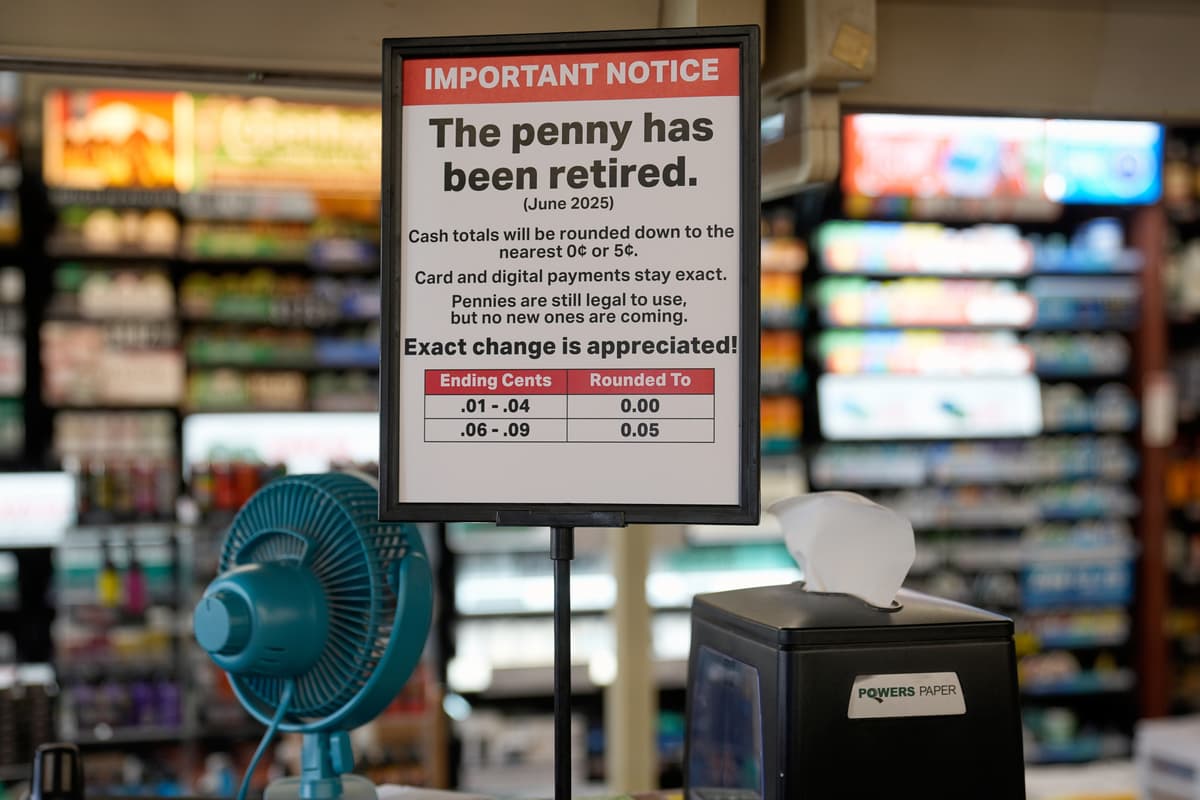

Similarly, Sheetz Convenience Stores has initiated a promotion offering a free soda to customers who make purchases using a dollar’s worth of pennies. Other retailers are encouraging the use of credit and debit cards to streamline transactions. Some are opting to round cash transactions to the nearest nickel as a temporary measure.

Banks are also feeling the impact of this shortage, implementing rationing measures to conserve their limited supplies of pennies. High-volume customers are prioritized in access to these coins, further complicating the situation for smaller retailers and cash-dependent businesses.

International Perspectives on Penny Elimination

Despite the challenges posed by the current penny shortage, there are positive precedents from other countries that have eliminated their one-cent coins without dire economic consequences. Nations such as Canada, Australia, Ireland, and New Zealand have successfully transitioned away from the penny.

In Canada, the last penny was minted in 2012, and while there was some initial confusion at cash registers, residents adapted quickly. Cash transactions are rounded to the nearest nickel, while electronic transactions continue to reflect exact amounts. Today, many Canadians report that they have largely forgotten about the existence of the penny.

As the U.S. navigates this shortage, it remains to be seen how long the impact will last and what long-term changes might occur in consumer behavior and cash transaction practices. Retailers are finding innovative ways to cope, but the ongoing dialogue regarding the future of the penny may pave the way for more significant changes in currency management.