As health insurance premiums in Colorado are set to double for many residents, families are grappling with the potential financial fallout. According to the state’s Division of Insurance, monthly costs for hundreds of thousands of Coloradans who have benefited from enhanced pandemic-era subsidies will see significant increases beginning in January 2026.

Alex Modisette, a cancer survivor from Castle Rock, exemplifies the tough choices many families face. Currently paying around $175 per month for insurance purchased on the state marketplace, her family will see that amount surge to $430 once the enhanced federal subsidies expire. Modisette, who has been in remission from thyroid cancer for a decade, emphasized her need for ongoing medical care. She stated, “If something bad happens, are we going to go bankrupt?”

The situation is particularly dire for families like the Modisettes, as their two children qualify for the Child Health Plan Plus, which aids kids from families earning too much for Medicaid. Unfortunately, Modisette and her husband lack a public coverage option, forcing them to contemplate going without insurance entirely.

Concerns about rising premiums extend beyond the Modisette family. In total, around 321,000 residents in Colorado received enhanced subsidies last year. These subsidies, which Congress has yet to extend, are critical for ensuring affordable health coverage in the individual marketplace.

Health Insurance Options Dwindle as Costs Rise

With monthly premiums projected to double, Coloradans facing these increases have several options. They can seek alternative coverage, opt for a less expensive plan within the individual marketplace, or risk going uninsured, thus shouldering the full cost of medical care. Individuals needing insurance by January 1 must select a plan by the end of this month; those who miss this deadline can still choose a plan by January 15 for coverage starting in February.

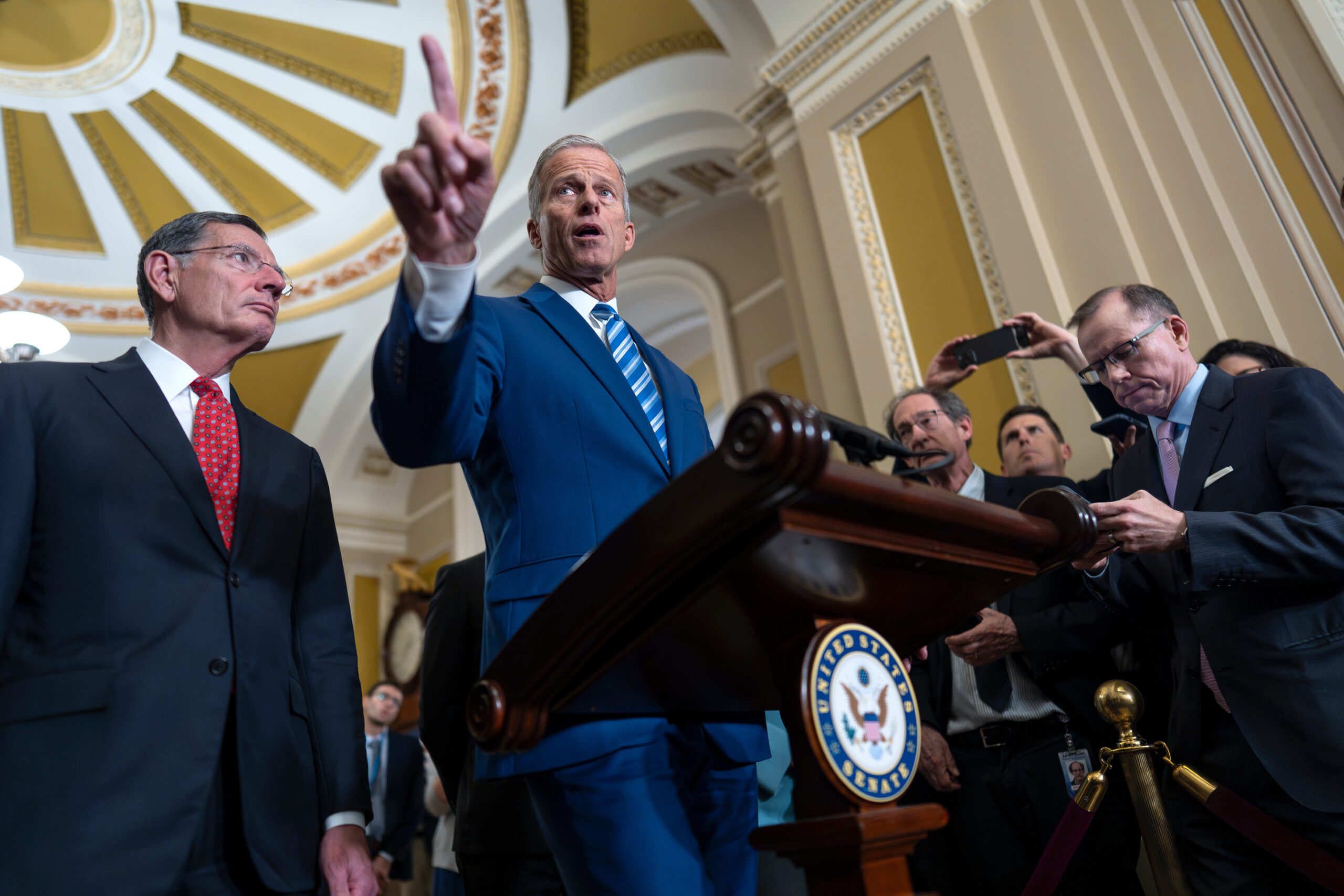

The legislative landscape complicates matters. Congress adjourned without extending these vital subsidies, but the House of Representatives is expected to revisit the issue in January. A coalition of four Republicans has joined Democrats in a push to secure a three-year extension of the subsidies, without substantial alterations. However, the Senate previously rejected this proposal, which could hinder progress.

Roger Allbrandt, a resident of Centennial, shared his concerns about potential premium increases. His plan, which currently costs $35 per month, could skyrocket to $862 if subsidies are not extended. “I never have an extra $800 a month to pay for health insurance,” he lamented. Allbrandt plans to rely on the Rocky Mountain Regional VA Medical Center for primary care if his situation does not improve.

For others, the loss of subsidies is forcing difficult decisions. Kate Tynan-Ridgeway, a retired teacher, has opted for a plan through the Colorado Public Employees Retirement Association, which costs $800 monthly but carries a $4,000 deductible. “I’m making harder decisions about when to seek health care,” she noted. Tynan-Ridgeway’s husband recently transitioned to Medicare, which has helped reduce their overall expenses, yet she is still considering picking up additional work to offset rising costs.

Struggles with Affordability Amplified Nationwide

The issues facing Coloradans reflect a broader national trend. A survey by the health policy group KFF found that about one-third of marketplace enrollees would switch plans if faced with doubled costs, while a quarter indicated they might forgo insurance altogether. Approximately half of respondents already struggle to afford their premiums, and many report difficulty meeting their deductibles.

Myshel Guillory from Eagle is another individual reevaluating her health insurance strategy. Initially anticipating modest annual increases, she was shocked to see costs more than double. The most affordable plan available to her is around $1,000 monthly with a deductible of $12,000. “I planned, I worked hard, I did what I needed to do,” she remarked, highlighting the challenges of maintaining financial stability without adequate insurance coverage.

Insurance broker Leah Denzel emphasized that many individuals can still find affordable options, especially if they are willing to switch providers or adjust their expectations regarding care. However, those earning more than four times the poverty line, which is about $62,000 for an individual, will no longer qualify for any premium assistance.

As Congress prepares to reconvene, the fate of health insurance subsidies remains uncertain. Denzel advises her clients to select Affordable Care Act plans that they can afford without enhanced subsidies. She warns against opting for short-term plans or health-sharing ministries, which may not adequately cover pre-existing conditions.

In the face of rising premiums and potential loss of coverage, Coloradans and many others across the nation are left weighing their options and contemplating the future of their health care in an increasingly complex landscape.