UPDATE: Southern California has confirmed its status as the nation’s priciest region for warehouse rents, with Orange County leading the charge at an astonishing $17.09 per square foot, reflecting a staggering 7% increase over the past year. This urgent news comes as a recent report from Commercial Cafe reveals critical metrics for industrial real estate, underscoring the escalating demand for logistics space in the area.

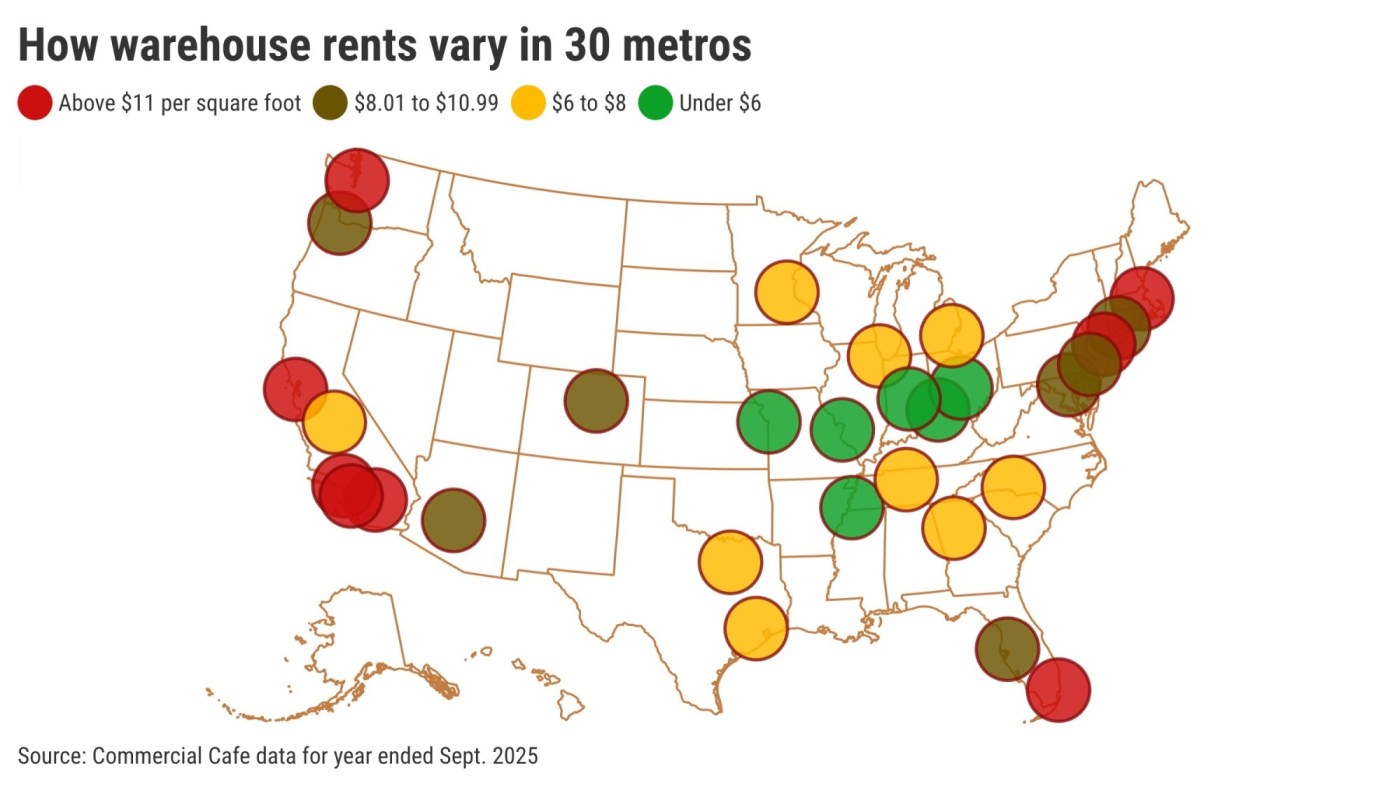

The Los Angeles market follows closely, with warehouse rents averaging $15.59 per square foot, marking a 5% rise in just one year. In stark contrast, the national average stands at just $8.72, highlighting the exceptional pressure on local tenants. New leases in Los Angeles have reached an average cost of $14.88 per square foot, placing it among the top six markets nationwide.

The soaring costs in these regions drive many businesses to seek space in the Inland Empire, where rents appear more manageable at $11.65 per square foot—an 8% increase year-over-year. However, even these prices rank as the seventh-highest in the country, with new leases averaging $14.58 per square foot.

Why does this matter RIGHT NOW? Southern California’s warehouses play a vital role in the logistics of goods flowing through the Los Angeles/Long Beach ports, one of the largest shipping hubs globally. The region’s extensive logistics network supports the needs of the nation’s second-most populous area, making the demand for warehouse space relentless despite the high costs.

Vacancy rates in the Inland Empire are currently at 7.7%, the eighth-lowest among thirty major U.S. markets. Orange County and Los Angeles follow closely with vacancy rates of 8.2% and 8.3%, respectively. These figures are notably below the national average of 9.5%, indicating a tight market where finding available warehouse space is increasingly challenging.

Additionally, these high rents translate into elevated selling prices for industrial properties. In the first nine months of 2025, industrial properties in Orange County sold for an average of $306 per square foot, making it the second most expensive market after Detroit. Los Angeles properties commanded prices of $282 per square foot, while the Inland Empire saw sales at $234 per square foot.

This urgent update sheds light on the ongoing real estate trends in Southern California, revealing the acute pressures on businesses grappling with soaring rental costs. As companies continue to compete for limited warehouse space, the implications for logistics and supply chains in the region are profound.

Stay tuned for more updates as this situation develops.